How to Create Your Own Trading System

Nowadays, it seems like everywhere we look we see ads for software promising precise buy and sells signals and of course, profits with every trade. It’s because of these ads your average Joe thinks trading systems are nothing more than scams aimed at his pocketbook.

However, have you ever wondered if this modern stereotype is justified or can a trading system offer good trading methods?

This article aims to answer that question properly and explain what a trading system actually is. If you ever wanted to learn how to day trade, but you were too afraid to do it, here we have everything you need to know before you make your choice.

What exactly is a Trading System?

In its essence, a trading system is a group of rules and parameters, which are there to determine entry and exit points – also known as signals – for certain inquiries. The points are marked on a chart and are there to notify you about immediate trade executions, in real-time.

Some of the tools used to create the parameters of a trading system include:

- Bollinger bands

- Stochastic

- Relative strength

- Oscillators

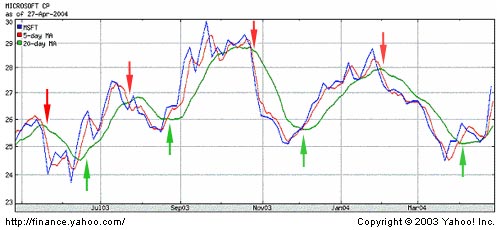

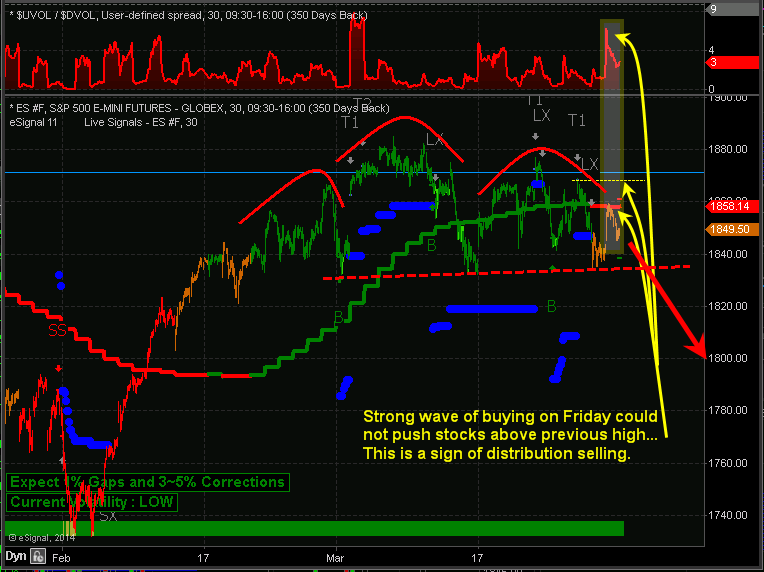

- Moving Averages

In most cases, at least two of these tools are used in the creation of a rule, although some rules even use just one. For instance, a trading system might have a rule that prevents any buying, unless the strength is above a specific level. Nonetheless, the combination of all of these rules makes a trading system.

The next thing you need to realize is that the success of a particular trading system depends on how the rules perform. That’s why traders spend a lot of time optimizing in an effort to manage risk and get some stability.

This happens through the modification of different parameters within a given rule. But optimization will only get you so far – the combination of parameters used is what really determines the success of a particular trading system.

Pros and Cons of Trading Systems

Here we have some of the main advantages of using a trading system:

- These systems take all the emotions out of trading: Individual investors usually cite emotions as their biggest flaws. People who aren’t able to cope with huge loses often second-guess themselves too often and in the end, lose money. Pre-developed systems allow you to cut down on your indifference and increase your profits in the process.

- They also can save you a lot of time: If you have a fully-developed system on your hands, you don’t have to do much work. Not only will a system automate the signal generation, but the trading process as well. This means you won’t have to spend countless hours making trades and analyzing the market anymore.

- Some companies sell action-ready systems: Some people simply don’t have the technical know-how to develop a trading system. Luckily, some companies out there will provide you with the signals created by their internal systems for a fee. Just make sure to be careful, because some of these companies are fraudulent.

And now, we should also say a few words about the disadvantages:

- These systems may be too complicated for some: We have to talk about the biggest disadvantage first. Every trading system demands a strong understanding of technical analysis and the ability to make informed decisions through the knowledge of how parameters function. Even if you don’t develop a system on your own, you still need these skills.

- Simulated results sometimes differ from actual ones: It’s almost impossible to test one of these systems accurately. Needless to say, this causes a certain degree of uncertainty when it comes to testing the system in real-life situations. Sometimes, slippage happens – simulated results that are completely different from actual ones – and you end up losing a lot of time and money.

- Development can be awfully time-consuming: You probably realize at this point that developing a successful trading system takes some time. While a system will save you a lot of time in the long run, initially, you have to test it more than a few times. A system also has to be paper traded in real-time if you want to make sure it’s reliable.

Do Trading Systems Actually Work?

As we’ve already established, trading systems are often related to online scams. But you need to keep in mind that there are many legit systems out there. Just look at the famous Turtle Trading System, developed originally by Richard Dennis and Bill Eckhardt, which is turning 35 this year.

The TTS made trading systems famous back in the 80s, and in the next few decades, trading systems became more prevalent than ever. Today, professional traders and individual investors use them every day – and that’ possibly a testament to how well these systems work.