Setting Up an Optimal Day Trading Workstation: A Comprehensive Guide for Active Traders

In the world of financial trading, having a well-equipped desk setup isn’t just for show—it’s a vital part of a day trader’s overall strategy. From the hardware that powers your trading, to the software and tools that give you the edge, your workstation can significantly impact your ability to make profitable trades. In this post, we’ll walk you through setting up a day trading workstation that optimizes both your efficiency and performance.

Choosing the Right Hardware

Your computer hardware forms the backbone of your trading setup. For the best real-time data processing and analysis, you’ll need high-performance devices.

Computer: While the debate between desktops and laptops continues, many traders opt for custom-built desktop trading computers due to their superior processing power and reliability. Look for a computer that has a fast processor, plenty of RAM (16GB minimum), and solid-state drive storage for quick data access.

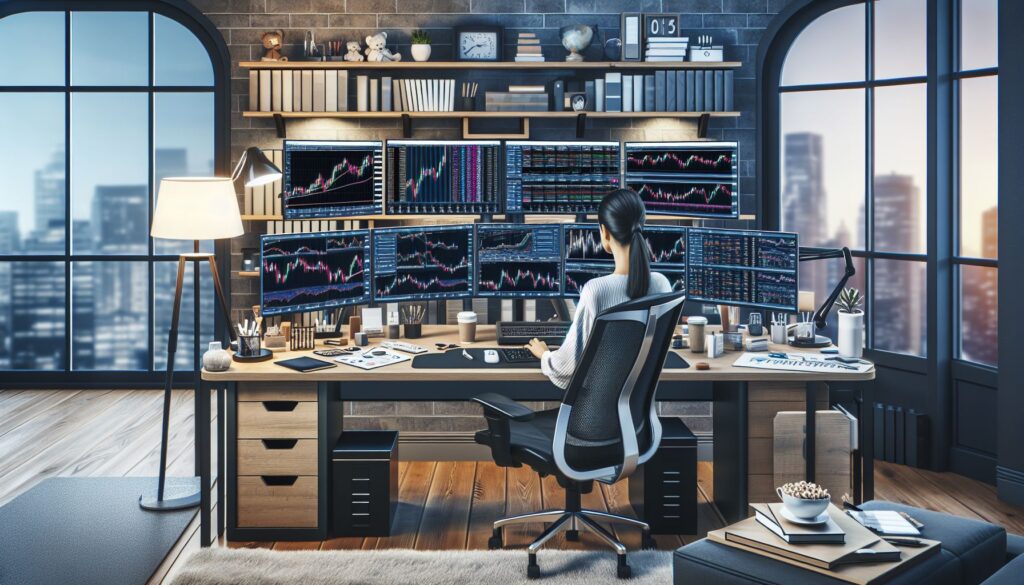

Monitors: To effectively monitor global markets and execute trades, you’ll need multiple monitors. A setup with 2-4 screens is common, but some seasoned traders even use six or more. Quality is important as well; consider monitors that offer high resolution, adequate screen size (24 inches is standard), and a quick refresh rate.

Internet: A reliable and high-speed internet connection is absolutely critical in day trading. Look for an internet service provider that offers low latency and can handle heavy data usage.

Selecting Your Trading Software

Once you have your hardware ready, it’s time to choose the right trading software. A good trading platform should offer real-time streaming of market prices, advanced charting features, and a user-friendly interface.

Charting and Trading Platforms: Platforms like MetaTrader, NinjaTrader, and TradeStation offer extensive features and are popular among day traders. Make sure to choose a platform compatible with your broker.

Market Data Service: A real-time market data service is vital for day trading. Services such as eSignal, Bloomberg, or Reuters provide accurate and comprehensive data feeds.

Risk Management Tools: Never underestimate the importance of managing risk. Software tools like TradeRisk and EquityFeed can help you monitor your exposure and set stop-loss orders.

Arranging Your Day Trading Workstation

An efficient workspace that minimizes distractions and maximizes productivity is crucial. A proper ergonomic chair, a spacious desk, and appropriate lighting can alleviate potential physical strain and enhance focus.

Conclusion

Setting up a day trading workstation is a critical step in your trading journey. The right tools and environment can drastically enhance your efficiency and help you keep pace with the fast-moving world of day trading. Remember that while a good setup can aid your trading, it’s ultimately your strategy, knowledge, and discipline that will determine your success in the market.

Remember, every trader is unique, and there’s no ‘one-size-fits-all’ when it comes to setting up a trading station. Your setup should match your individual needs, budget, and personal comfort. Happy trading!