The Elliott concept currency markets

Among the important things that makes victimisation the Elliot Wave therefore sophisticated is timing– of all the numerous wave ideas, it’s the just one that doesn’t place a timeframe on the responses and conjointly rebounds of the marketplace. A solitary Actually, the concepts of shape maths makes it clear that there ar a variety of waves at intervals waves at intervals waves. Analyzing the information and conjointly discovering the best contours and even crests may be a tough procedure, that triggers the opinion that you might place twenty professionals on the Elliot Wave conception in one space likewise as they’ll actually ne’er ever get to a meeting on which methodology a stock– or during this instance, a money– is goinged.

Among the most effective understood and even the very least recognized ideas of technological analysis in interchange mercantilism is that the Elliot Wave conception. Created within the 1920s by Ralph full admiral Elliot as a method of prognostication patterns in the stock market, the Elliot Wave concept uses shape maths to motions on the market creating forecasts primarily based upon cluster actions. In its importance, the Elliot Wave concept mentions that the marketplace– in this state of affairs, the foreign exchange market– relocate a set of 5 swings upwards likewise as three swings pull back, restarted constantly. Yet if it were that easy, every person will surely be creating a murder by capturing the wave likewise as victimisation it until right before it collapses on the coast. Clearly, there’s a great deal longer thereto.

Elliot Wave Essential

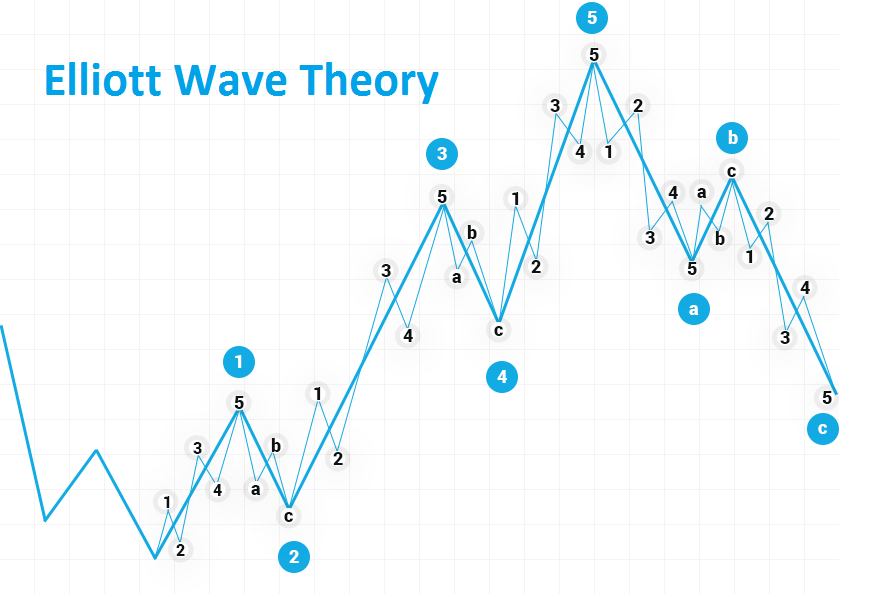

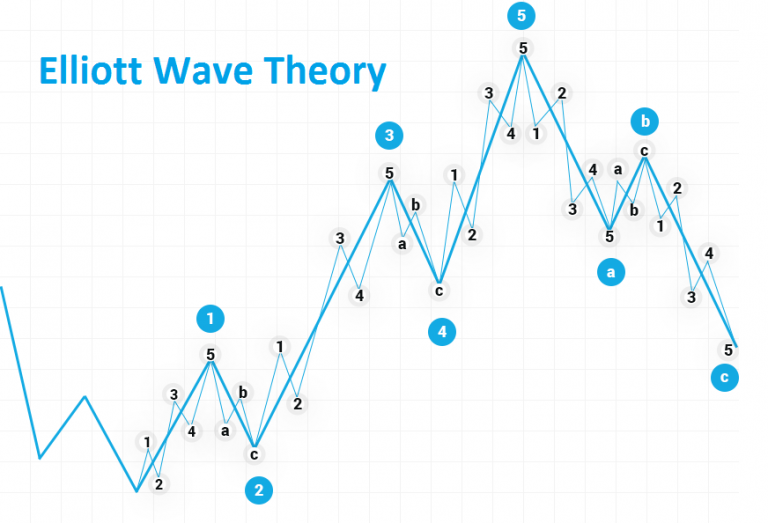

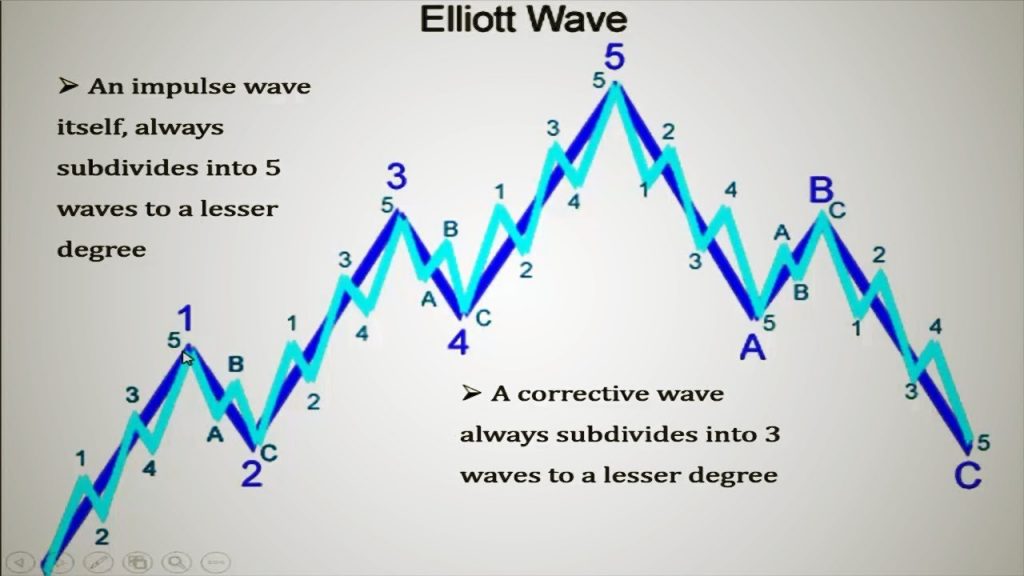

– This 5-3 step after that lands up being two communities of the subsequent bigger 5-3 wave.

In Elliot Wave symbols, the 5 waves that work the fashion ar classified one, 2, 3, 4 and conjointly five (impulses). The 3 remedying waves ar referred to as a, b as well as c (modifications). Each of these waves consists of a 5-3 assortment of waves, and even each of those is comprised of a 5-3 assortment of waves. The 5-3 pattern that you’re examining is an impulse and even adjustment in the following rising 5-3 assortment.

– Every activity is complied with by a response.

It’s a conventional regulation of physics that puts on the cluster actions on that the Elliot Wave conception relies. If rates decline, home owner will actually purchase. When people acquire, the need boosts and even provide reduces driving prices duplicate. Virtually each system that utilizes pattern analysis to anticipate the activities of the cash market relies upon establishing once those activities will definitely produce responses that build a profession rewardful.

– The underlying 5-3 pattern continues to be continuous, though the moment amount of every may take issue.

A 5-3 wave may take years to finish– or it might finish in minutes. Investors that succeed in operation the Elliot Wavy concept to sell the cash market claim that the strategy is temporal order professions to accompany the beginning likewise as finish of impulse three to scale back your threat likewise as optimize your earnings.

The element remains in analyzing the pattern properly– in discovering the acceptable starting issue. As soon as you discover however to see the wave patterns and conjointly verify them properly, state those that are professionals, you’ll see exactly however they use in each component of foreign exchange mercantilism, as well as will definitely have the power to create use of these patterns to activate your choices whether or not you’re day mercantilism or in it for the long-standing time.

– A 5-3 action finishes a pattern.

And even right here’s where the conception starts to acquire fully tortuous. Like the mirror showing a mirror that mirrors a mirror that shows a mirror, the each 5-3 wave is not simply full by itself, it is a superset of a smaller sized collection of waves, and also a half of an even bigger assortment of 5-3 waves– the subsequent conception.

– There are five waves towards the primary fashion adhered to by three rehabilitative waves (a “5-3” action).

The Elliot Wave concept is that market task might be forecasted as a set of five waves that relocate one directions (the fad) complied with by three ‘rehabilitative’ waves that relocate the marketplace back towards its starting issue.

Due to the very fact that the timing of every series of waves differs lots, making use of the Elliot Wave conception is quite a problem of study. Determining the most effective time to travel into and conjointly leave a profession depends on having the power to visualize likewise as adhere to the pattern of larger and even smaller sized waves, and also to acknowledge once to trade once to get out primarily based upon the patterns you establish.